How Technology Is Is Shaping the Fight Against Rental Fraud

As technology reshapes every facet of life, its role in the growing rental fraud crisis has come under scrutiny. A recent report uncovers alarming trends: scammers are weaponizing tech to exploit desperate renters, while the industry struggles to keep pace with adequate safeguards. The findings highlight both the risks and opportunities for technology to redefine how we approach fraud prevention in the rental market.

Rental Fraud: A Digital Problem with Real-World Consequences

The data paints a grim picture. According to the 2024 Rently Survey: Rental Scams and Fraud Report, 93% of surveyed renters believe scams are common, and 90% admit they fear becoming victims themselves. Fraudsters, armed with sophisticated tools, leverage platforms like Facebook—where 88% of scam victims encountered fake listings—to cast a wide net. These fraudulent ads often feature ideal locations, below-market prices, and immediate availability to lure renters into paying deposits and fees before disappearing entirely.

The financial toll is significant. More than 60% of victims reported losses exceeding $500, and nearly half lost over $1,000. For some, the damage reached upwards of $5,000. But beyond the numbers, the emotional toll is just as severe. Victims report feeling betrayed, anxious, and hesitant to trust future rental transactions.

The Double-Edged Sword of Technology

Technology is both a blessing and a curse in the rental market. On the one hand, scammers exploit the reach and minimal safeguards of platforms like Facebook and Craigslist. On the other, advancements in fraud prevention tech could be the industry’s strongest ally.

Here are some of the tools that could reshape fraud prevention:

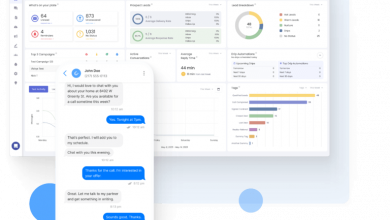

- Landlord Verification Systems: Identity verification tools can prevent fraudsters from impersonating landlords, a common tactic in rental scams.

- Secure Payment Processing: Platforms with built-in payment systems can protect renters by ensuring their money goes to verified landlords or property managers.

- AI-Powered Scam Detection: Algorithms trained to identify suspicious patterns—such as listings with stock photos or unusually low prices—can flag potential scams before they reach renters.

- Real-Time Property Viewing: Live virtual tours or self-guided walkthroughs can confirm a property’s existence and condition, giving renters confidence in their choices.

By integrating these technologies, rental platforms can build trust while protecting users from increasingly sophisticated scams.

The Education Gap: Where Tech Alone Falls Short

While advanced tools can deter many scams, technology alone isn’t enough. 92% of renters said it’s “important” or “very important” to educate the public about rental scams and fraud. Many renters are unaware of red flags like immediate payment demands, lack of property tours, or deals that seem too good to be true.

Rental platforms and property management companies can bridge this gap by offering website materials about common scam tactics, scam alerts, and open lines of communication for individuals to report suspicious activity.

Education empowers renters to use technology responsibly, making them less vulnerable to fraud.

Rebuilding Trust Through Transparency and Innovation

One notable finding from the report is the erosion of trust in online rental platforms. Nearly 40% of renters expressed distrust. This skepticism isn’t just a reaction to fraud—it reflects a broader frustration with the lack of proactive protections.

For the industry, this presents a chance to rebuild trust through innovation. Rental platforms and property managers that prioritize transparency, invest in secure technologies, and communicate openly about their processes can set themselves apart. Verified landlord profiles, secure payment systems, and scam detection tools aren’t just features—they’re trust builders.

The Future of Fraud Prevention: Collaboration Is Key

No single player can solve the rental fraud problem alone. Effective fraud prevention will require collaboration between technology providers, property management companies, and rental platforms. Governments and regulators can also play a role by supporting standards for fraud prevention tools and practices.

Renters are looking for a safer, more transparent rental experience. Platforms that rise to this challenge won’t just protect their users—they’ll position themselves as leaders in a competitive and fast-evolving market.

The intersection of technology and the rental market is full of potential and pitfalls. Fraudsters will continue to innovate, but so can the industry. By investing in advanced tools, educating renters, and fostering collaboration, we can turn the tide on rental fraud.